Click here to learn more

Actual Cash Value and Replacement Cost Explained

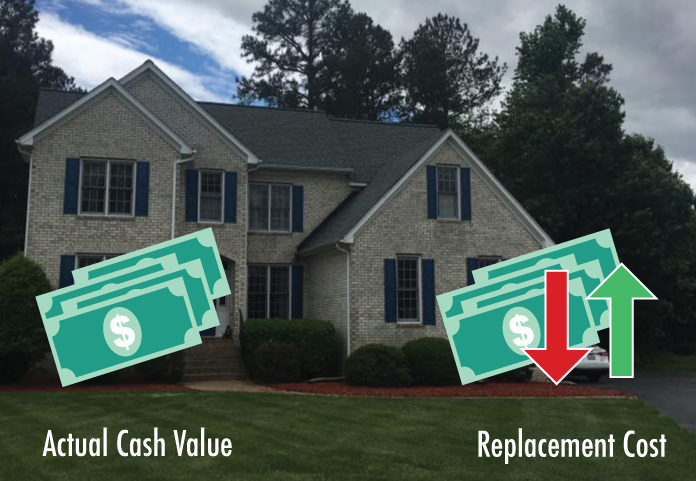

When you purchase an insurance policy, you are given the choice of covering items for actual cash value (ACV) or for replacement cost. While both methods can help cover the cost of replacement or repairs to your damaged property, they do not follow the same calculation process when you file a claim.

Both reimbursement methods base their calculations on today’s cost of replacing a damaged item with a new property. The difference between them is that ACV factors in a deduction for depreciation.

In order to know how much financial assistance you’ll receive to cover a lost or damaged item, let’s take a closer look at how each one works:

What is Actual Cash Value?

Most insurance companies prefer reimbursing their policyholders through actual cash value. This is because the insurance providers will take several factors into account when calculating the coverage cost of an item. These include:

- The age of your insured item

- The state of your property before it was stolen or damaged

- The insurance adjuster’s visual observations

- The amount of wear and tear the item sustained

As a result, insurance providers can charge premiums at a lower rate when calculating claims with the ACV process. ACV will pay for the damages equal to the item’s replacement cost minus its depreciation value (ACV = replacement cost – depreciation).

What is Replacement Cost?

Replacement cost, on the other hand, means the insurance company will reimburse you the full cost of replacing the stolen or damaged item with a new one of like and kind. Unlike ACV, it does not deduct the object’s depreciation value. Although replacement cost provides a higher figure for the policyholder, it usually comes with a higher premium as well.

With each policy renewal, you have to continue increasing your replacement value, as well as your monthly premium, to keep up with the inflation cost of the replacement item.

Trust Low Cost Insurance to Find an Insurance Plan to Fit Your Budget

For most homeowners or business owners, the cost of monthly premiums is an overriding factor in determining whether they choose the ACV or replacement-cost option on their policy. Regardless of which option you choose, contact Low Cost Insurance when you seek a reliable, cost-effective insurance company in Houston and Cypress, Texas. We offer comprehensive plans and policies that are tailored to fit your needs and budget. Give us a call at 281-612-7178 to get a free estimate or learn more about our policy options.